Most likely, the financial world won't be the same after 2022. In the future, we can expect to see more changes in how people live and how they talk to each other.

Fintech financing has dropped a lot in Q2 2022. It is at its lowest level in the last five quarters and is down 39% from its peak in Q4 2021.

But even so, fintech is still the industry with the most investment rounds. It got $21.5 billion from all over the world in Q2 2022.

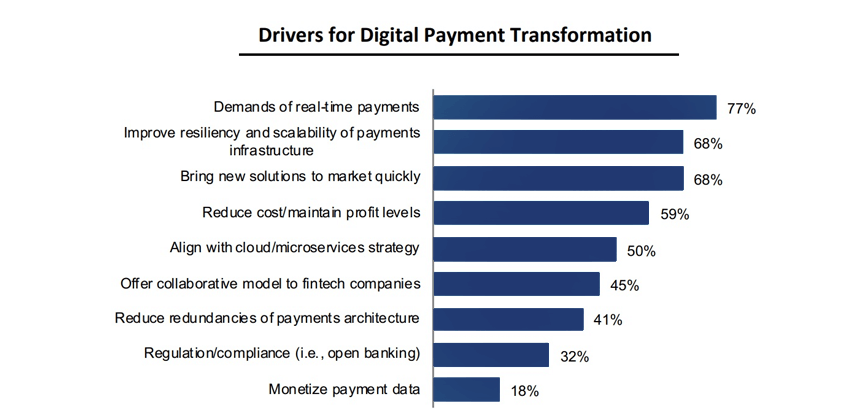

About 90% of people in the United States now use services that use fintech. Digital financial processes are now more customer-focused because of global quarantines and lockdowns. It encourages fintech companies to keep up with the times and use the newest technologies so they can keep up with customer expectations and keep a high satisfaction rate.

The fintech market is expected to be worth $698.48 billion in 2030, up from $110.57 billion in 2020. Both new businesses and companies that have been around for a while are keeping up with the speed of change and making sure their operations are up to date. They are also getting enough technical skills and tools.

Scaling is the key to success. A scalable solution must also be useful. For a competitive edge in 2023, you may want to adopt new fintech industry trends.

We looked into the finance industry to find out how fintech companies will try to get better at what they do. From BNPL to cryptocurrencies, how the payment world will become digital and change, and what role fintech innovation will play in the next few years, we've talked about all of these and more in this blog post.

One tool doesn't support a certain payment method, another doesn't work across borders, and one's commission is too high. To make up for these problems, business owners need to use a lot of different services together. In 2023, one of the most important fintech trends will be to make the payment stack as simple as possible.

One tool doesn't support a certain payment method, another doesn't work across borders, and one's commission is too high. To make up for these problems, business owners need to use a lot of different services together. In 2023, one of the most important fintech trends will be to make the payment stack as simple as possible.

Payoneer is a great example of a payment system that can be used in over 200 countries. It lets the fintech company work with many banks and businesses and gives it a strong presence around the world.

Airbnb, Univera, and other companies that work with people from all over the world list Payoneer as their main payment method. This fintech trend says that companies that use fintech to make payments should focus on getting international partners and connecting to marketplaces.

Business management is changing as a result of banking as a service. Integrating automated payables with your online banking platform could save you time, energy, and treasure. Managing your customers and vendors efficiently requires integrating payments with payables.

- Anthony Holder, C&H Financial Services, Inc.

Payoneer is a great example of a payment system that can be used in over 200 countries. It lets the fintech company work with many banks and businesses and gives it a strong presence around the world.

Airbnb, Univera, and other companies that work with people from all over the world list Payoneer as their main payment method. This fintech trend says that companies that use fintech to make payments should focus on getting international partners and connecting to marketplaces.

Business management is changing as a result of banking as a service. Integrating automated payables with your online banking platform could save you time, energy, and treasure. Managing your customers and vendors efficiently requires integrating payments with payables.

- Anthony Holder, C&H Financial Services, Inc.

Let's Get Right to the Top Fintech Trends without Further ado!

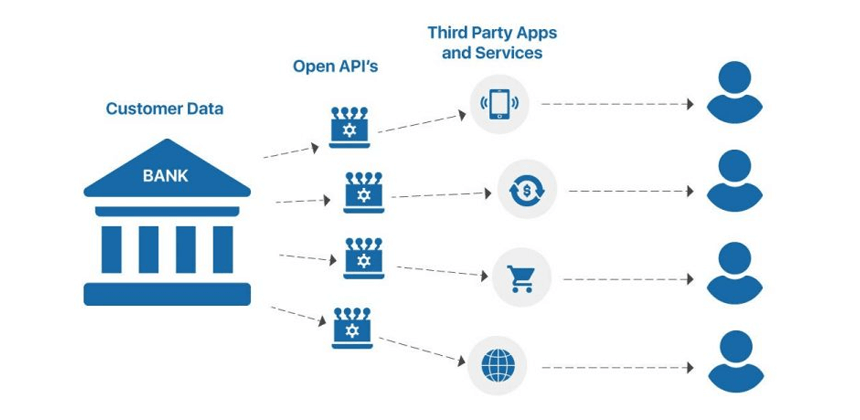

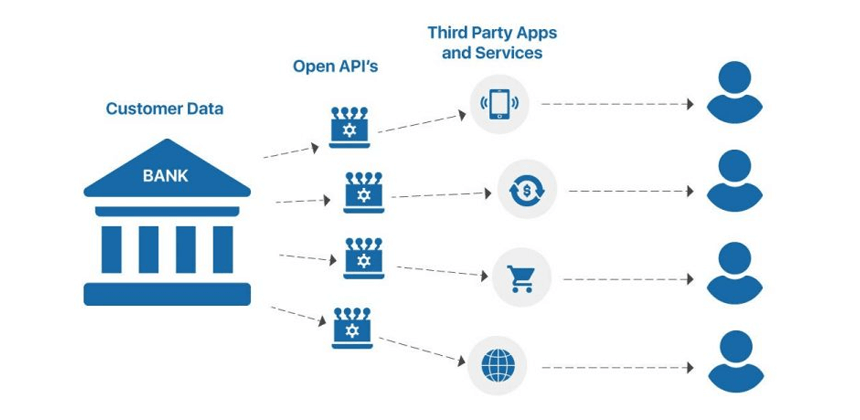

Open Banking

The open banking sector will be used by 63.8 million people in 2024, according to Statista. The increase is almost five times greater than in 2020. Open banking is based on the controlled exchange of financial information. Account holders can agree to procedures that make it safe for them to share their financial information with institutions that aren't banks. Accessible APIs let third-party suppliers see the financial information of the client. Open banking prospects are used by a lot of fintech companies that offer budgeting, tracking of expenses, financial planning, lending, and other services. McKinsey says that only 10% of the potential of open banking is being met. This financial technology seems to have potential. Users are slowly starting to see the benefits of working with open data, since sharing information helps with research, software development, and making financial services better. In the purchase and financing of products, the movement of money, and other transactions, open banking and APIs will simplify, accelerate, and drive greater transparency. Lenders will use richer data sets to model their credit models, resulting in lower loan rates and more frequent approvals. - Greg Mitchell, First Tech Federal Credit Union For example, a loyal customer may decide not to switch banks because they are happy with how reliable and stable their current bank is. But the bank is very traditional, and many of the digital services that competitors offer have not yet been adopted.- • In order to analyze customer spending and spending patterns, the client wishes to link analytics tools to financial data.

- • Retaining dependable clients is important to the bank.

- • In turn, it provides analytics data via API to a third party. APIs facilitate this process.

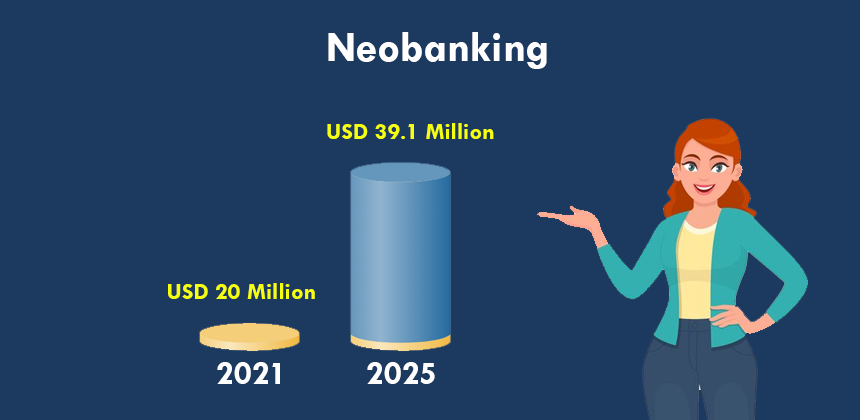

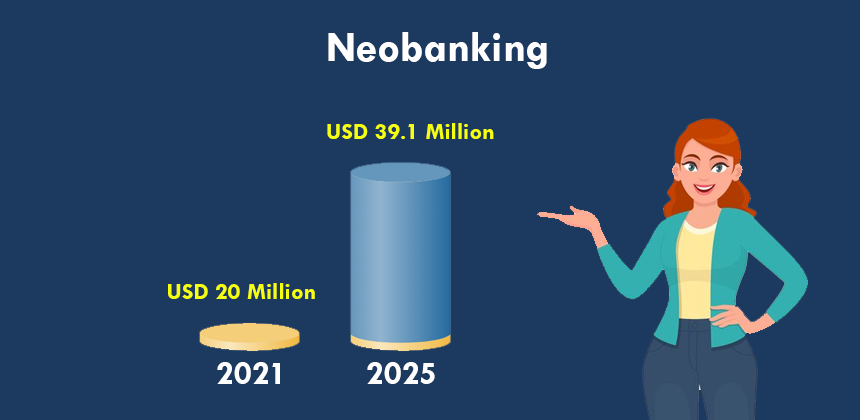

Neobanking

We've learned from the pandemic that we can do anything from home, and so has the financial industry. The growth of neo-banks has been helped by FinTech. Neobanks are like traditional banks, but they don't have any buildings.- • So, Neo banks have everything that a traditional bank branch has. Instead of traditional bank branch models, many new FinTech businesses are only focused on the Neo banking idea. Companies and customers both benefit from this method because it saves money and is easy to use.

- • Neobanks are a type of fintech company that helps to make banking services more affordable. Compared to bigger banks, they often offer fewer types of services, but they focus on the ones they do offer to make them better.

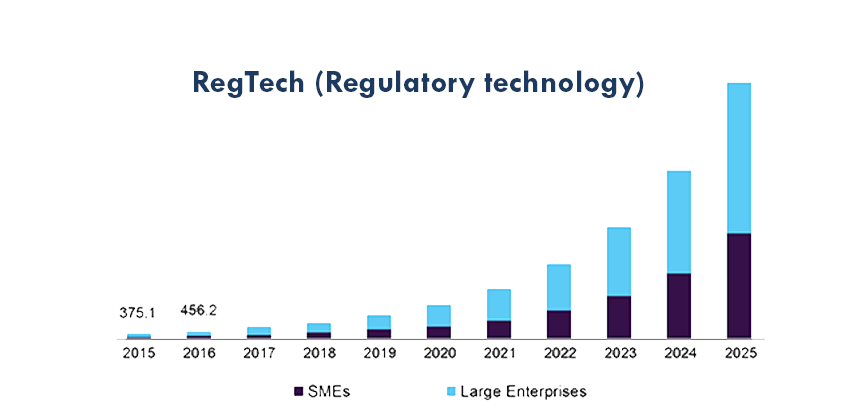

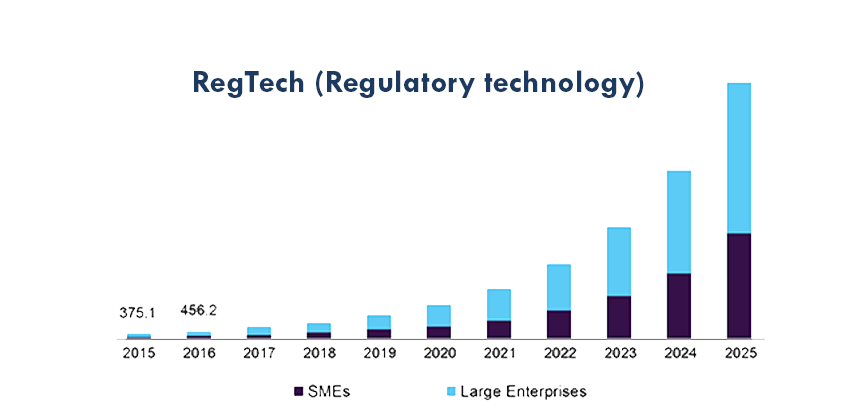

RegTech (Regulatory Technology)

The way a financial institution works is governed by laws, standard practises, and rules that everyone needs to know and follow. Accounting records, tax reports, income reports, and customer reports are all things that businesses need to keep track of. In accordance with the schedule, they send the necessary paperwork to the regulatory bodies. They make sure that the information is correct and that the activity is legal. In this case, regulatory technology can help. RegTech is a type of technology that is used to make sure that rules are being followed. Regulatory technology finds problems that don't follow the rules and makes them fit into the system. Specialized software takes care of repetitive tasks, keeps an eye on data security, and warns users and bank employees about fraud. For not following the rules, you can be fined millions of dollars. For example, the Bank of America Corporation once had to pay $42 million to the state of New York because it only gave clients a brief explanation of how their share orders were handled. RegTech makes it easier for organizations to talk to their regulatory authorities so that data can be sent without interruption, compliance can be monitored (for example, by following PCI compliance rules), and financial crimes can be tracked.Artificial Intelligence and Machine Learning

The global market for AI in fintech is projected to reach $26.67 billion by 2026, expanding at a CAGR of 23.17% between 2021 and 2026. More than 90 percent of worldwide fintech companies rely heavily on AI and machine intelligence. By collecting and analysing information regarding customers' cash accounts, credit accounts, and investments, AI helps financial institutions to monitor their clients' financial health and provide them with more personalised services. Smart banking services can be enhanced with cognitive automation, engagement, data analysis, and analytics capabilities. AI can:- • Data management,

- • Provide management strategies,

- • Detect human errors,

- • Ensure the quality of banking services.

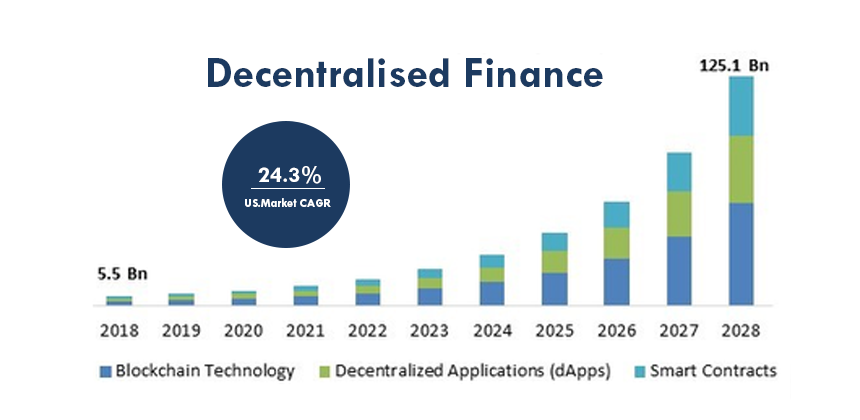

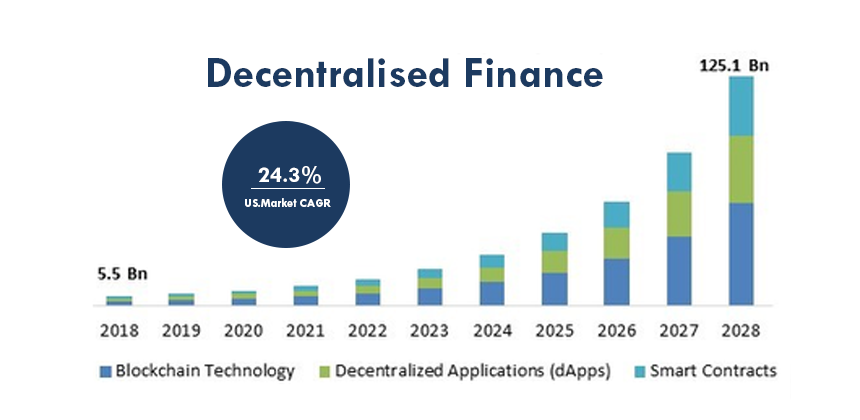

Decentralized Finance (DeFi)

A new fintech trend in 2023 is decentralized finance, which is linked to the cryptocurrency market and alternative financial instruments. A decentralised financial product is any financial product that operates without any central authority, such as:- • loans,

- • exchanges,

- • payment applications,

- • etc.

Blockchain

Before 2030, the global blockchain market will increase by 143 times and reach a total value of $1.5 trillion. Principal financial firms, such as Visa, Mastercard, and PayPal, have begun utilising cryptographic assets and enabling others to make cryptographic payments. International money transfer is now a time-consuming and expensive process. However, blockchain technology aims to remove these obstacles by enhancing the speed and security of international transfers and lowering their costs. Sometimes, blockchain technology is referred to as a distributed database or an electronic ledger. Each transaction is recorded in a distinct block that is linked to the network's previous blocks. All participants have access to it. A transaction is only valid if more than 50 percent of the participants agree to it. Because each block has a unique hash and each transaction requires verification, it is difficult to "open" a decentralized network. With Blockchain RBC's loyalty program, customers can get additional decentralised services. IBM World Wire, a distributed ledger technology launched by IBM, enables global cross-border payments, notably in African nations with inadequate local banking alternatives.Cryptocurrency

More over half (52%) of clients believe it is a "legitimate alternative" when it comes to foreign bank transfers. The rising value of these assets is a result of the global acceptance of cryptocurrencies by enterprises. In June 2022, for example, one of the largest payment providers in the world, PayPal, announced support for the native transfer of cryptocurrencies between PayPal and other wallets and exchanges. However, the sector is currently experiencing "crypto winter" issues that present new long-term prospects, including as the improvement of inefficiencies such as cross-border payment processing.

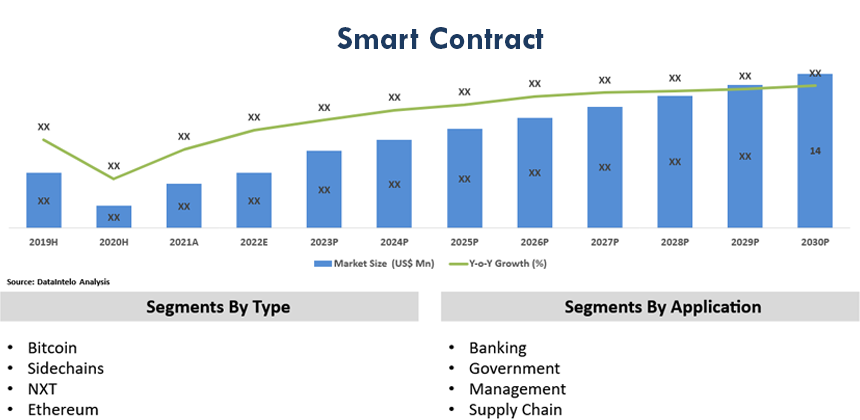

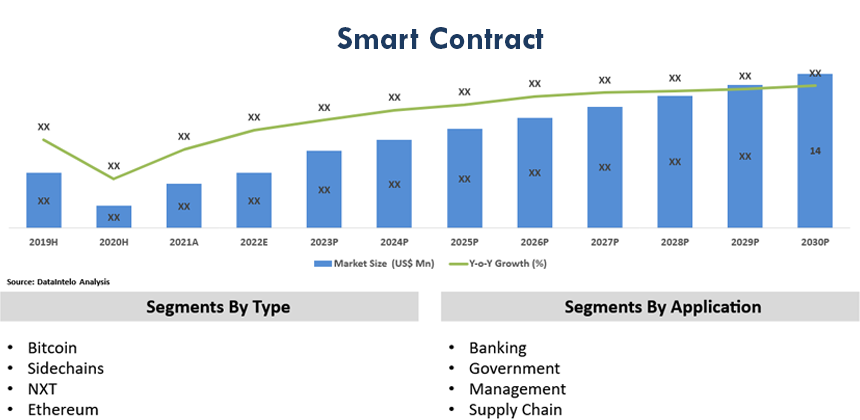

Smart Contract

Smart contracts are a fantastic FinTech innovation with widespread financial sector applications. It monitors and regulates the execution of virtual agreements between a buyer and a seller. Since the agreement is digitally signed using cryptographic keys, attorneys and paper documents are no longer required for virtual transactions. In the financial industry, smart contracts can be used to automate contracts without the need for a third party, such as a bank or loan officer. It indicates that buyers and sellers can safely enter into a legal contract without the involvement of banks. Future standardization of smart contracts may be made possible through DeFi fintech applications. Consider the fact that you need a mortgage. In lieu of visiting a bank, you can obtain a loan based on a smart contract and receive the money in a few minutes or less.

BNPL (Buy Now Pay Later)

The BNPL option is anticipated to be utilized in global transactions totaling $576 billion by 2026, up from $120 billion in 2021. The BNPL boom is worth watching if you are involved in any aspect of payments (whether B2C or B2B). Buy Now, Pay Later is a form of short-term financing that permits the payment of goods or services in the future. This typically operates without interest, making it a popular kind of financing. Customers that utilize point-of-sale installment loans make a down payment on an item and then pay the remaining balance in the future. BNPL is being implemented by Amazon and Affirm, which break payments into smaller monthly installments for purchases of $50 or more. PayPal, a multinational financial company, offers a widely known BNPL system. This service allows customers to split a maximum payment of $1,509 into four equal payments every two weeks. The initial payment is made at the time of purchase. There are no late fees or credit bureau reports filed by Pay.

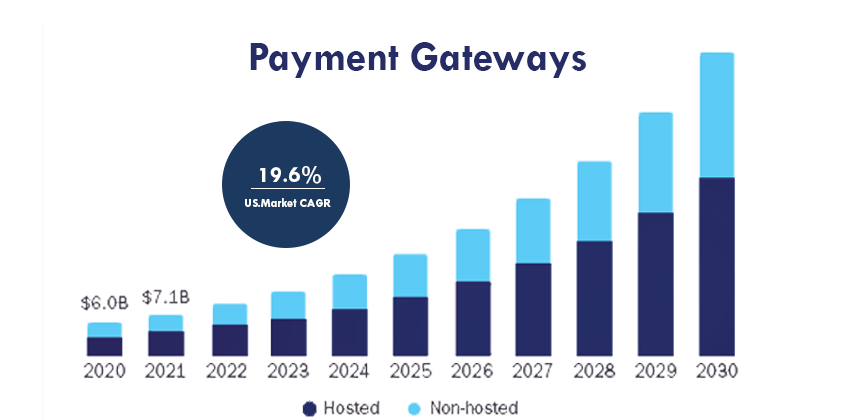

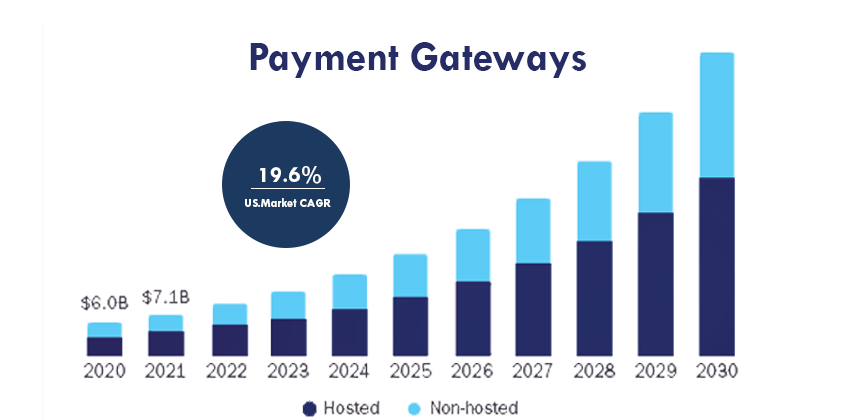

Payment Gateways

More than 55% of US customers buy things online with a credit card, and more than 52% use a debit card. For all of these deals, you need to build a payment gateway. Payment gateways connect customers and retailers so that bank-to-bank transactions can be done quickly and easily. The number of transactions and merchants is always going up, which is making the market for payment gateways grow quickly. It is worth $17.2 billion right now, but it will be worth $42.9 billion by 2025. One tool doesn't support a certain payment method, another doesn't work across borders, and one's commission is too high. To make up for these problems, business owners need to use a lot of different services together. In 2023, one of the most important fintech trends will be to make the payment stack as simple as possible.

One tool doesn't support a certain payment method, another doesn't work across borders, and one's commission is too high. To make up for these problems, business owners need to use a lot of different services together. In 2023, one of the most important fintech trends will be to make the payment stack as simple as possible.

Payoneer is a great example of a payment system that can be used in over 200 countries. It lets the fintech company work with many banks and businesses and gives it a strong presence around the world.

Airbnb, Univera, and other companies that work with people from all over the world list Payoneer as their main payment method. This fintech trend says that companies that use fintech to make payments should focus on getting international partners and connecting to marketplaces.

Business management is changing as a result of banking as a service. Integrating automated payables with your online banking platform could save you time, energy, and treasure. Managing your customers and vendors efficiently requires integrating payments with payables.

- Anthony Holder, C&H Financial Services, Inc.

Payoneer is a great example of a payment system that can be used in over 200 countries. It lets the fintech company work with many banks and businesses and gives it a strong presence around the world.

Airbnb, Univera, and other companies that work with people from all over the world list Payoneer as their main payment method. This fintech trend says that companies that use fintech to make payments should focus on getting international partners and connecting to marketplaces.

Business management is changing as a result of banking as a service. Integrating automated payables with your online banking platform could save you time, energy, and treasure. Managing your customers and vendors efficiently requires integrating payments with payables.

- Anthony Holder, C&H Financial Services, Inc.

Biometric Authentication

Business Performance Innovation Network says that clients will stop doing business with companies that use passwords instead of easy-to-use biometric identity verification procedures. Especially when it comes to getting access to money and other financial information, 81% of customers actively look for companies that can quickly verify or authenticate their identity. Companies that use this level of security have raised the bar, and fintech companies are paying attention. 93% of consumers say that the safety of their bank accounts is an important concern. This makes FinTech a top sector for biometric authentication technologies. Statista says that the biometrics market will grow from $42.9 billion in 2022 to $68.6 billion in 2025. When you put money into making a fintech solution safer, it works better. A fintech solution should safely store and process data and be able to stand up to cyberattacks. These are not new trends in fintech, but as online banking has become more popular, security measures have become more important. Biometric authentication is believed to be more secure than passwords and personal identification numbers (PINs). Dr. Thirimachos Bourlai of West Virginia University says that biometrics can protect personal information well from theft or fraud. Fingerprints and voices are both unique and can't be faked. Even though users have several passwords, they think biometric identification is the best way to prove who they are. They have to remember a new password every year, but they don't have to learn combinations of letters and numbers. Even if your laptop or phone is stolen, confidential information will still be safe. IDcheck is a British company that uses biometrics to verify people who work in financial services. The company's face recognition, liveness check, and motion analysis technologies are used to figure out who a paper belongs to. Also, it can spot con artists who hide their cameras with things or pictures to stop verification. IDcheck deletes all biometric information after giving a client a report, which protects their privacy in case of cybercrime. IDcheck's biometric screening is used, among other things, to verify documents and IDs and to find out who the customer is (KYC).

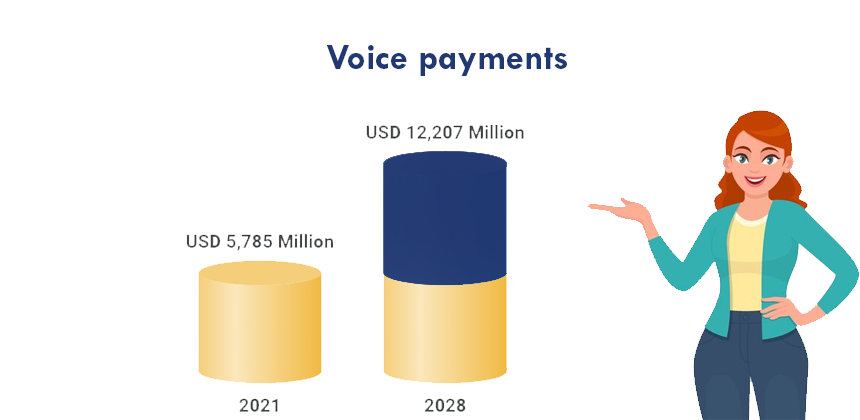

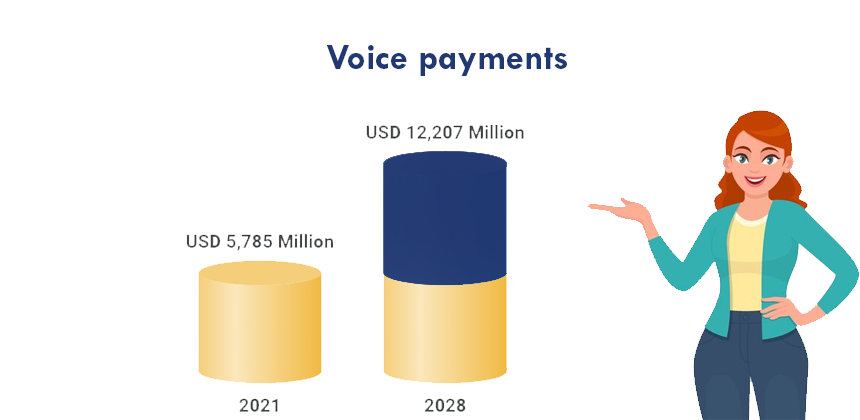

Voice Payments

By 2025, there will be 8.4 billion more voice assistants than humans on the planet, according to Statista. A fintech business hopes to increase digital assistant usage by integrating them into financial management. Voice biometrics will keep the user's information safe. The owner will be able to buy things, use voice commands to check the balance, and do other things all at the same time. The Capgemini Digital Transformation Institute says that 44% of people want to bank with voice assistants. Capital One is a leader in voice payments and has had Amazon Alexa for a long time, which lets clients pay their credit card bills. Other FinTech companies are replacing chatbots, managers, and call centre agents with voice assistants to help clients with complicated problems.

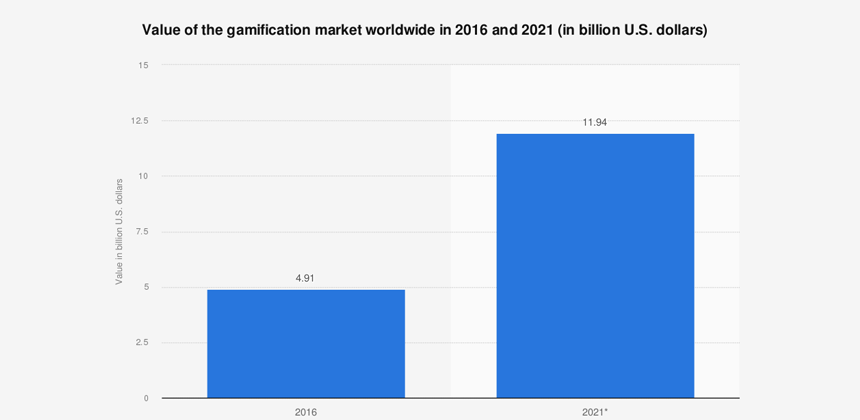

Gamification

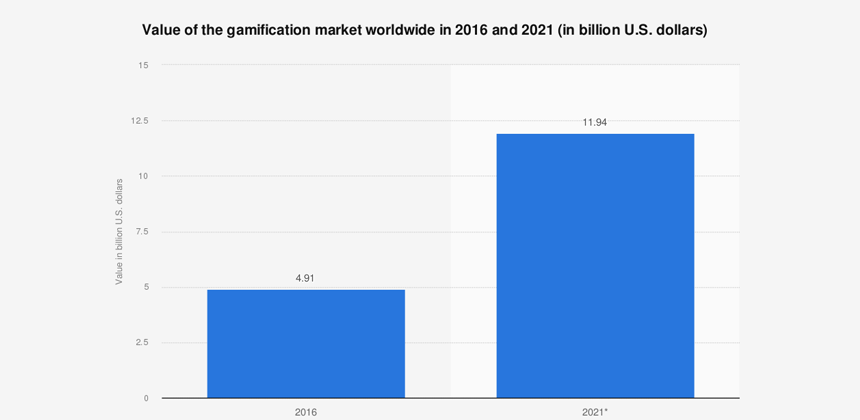

Fintech gamification is the use of technology in businesses to improve the customer experience. Business owners can increase revenue, customer loyalty, brand loyalty, and many other good things by gamification. As customers have become more used to using technology, they have become more careful about how companies use it. In the last five years, the value of the gamification market has gone up. Statista says that spending on gamification will go from $4.91 billion in 2016 to $11.94 billion in 2022. This is a huge increase. Gamification is becoming an integral part of many businesses' strategies to stay competitive and interesting. Gamification is gaining traction among companies like never before. In response, several businesses are using games to engage their customers and sell their products.Conclusion

Zestminds has a lot of experience building FinTech solutions, from automating payments to making personal tokens to building unique solutions based on B2B FinTech trends. Learn more about our work and look at our portfolio to get an idea of how much experience we have. If you have a unique idea, please don't wait to get in touch with us. With trends in fintech 2023, let's see what we can do to help you put your ideas into action.

Shivam Sharma

About the Author

With over 13 years of experience in software development, I am the Founder, Director, and CTO of Zestminds, an IT agency specializing in custom software solutions, AI innovation, and digital transformation. I lead a team of skilled engineers, helping businesses streamline processes, optimize performance, and achieve growth through scalable web and mobile applications, AI integration, and automation.

Stay Ahead with Expert Insights & Trends

Explore industry trends, expert analysis, and actionable strategies to drive success in AI, software development, and digital transformation.

March 14, 2023

Top Fintech Trends to Watch Out for in 2023

Stay Ahead with Expert Insights & Trends

Explore industry trends, expert analysis, and actionable strategies to drive success in AI, software development, and digital transformation.

March 14, 2023